Finace Past Years

Scroll down to Find 2018 – 2002

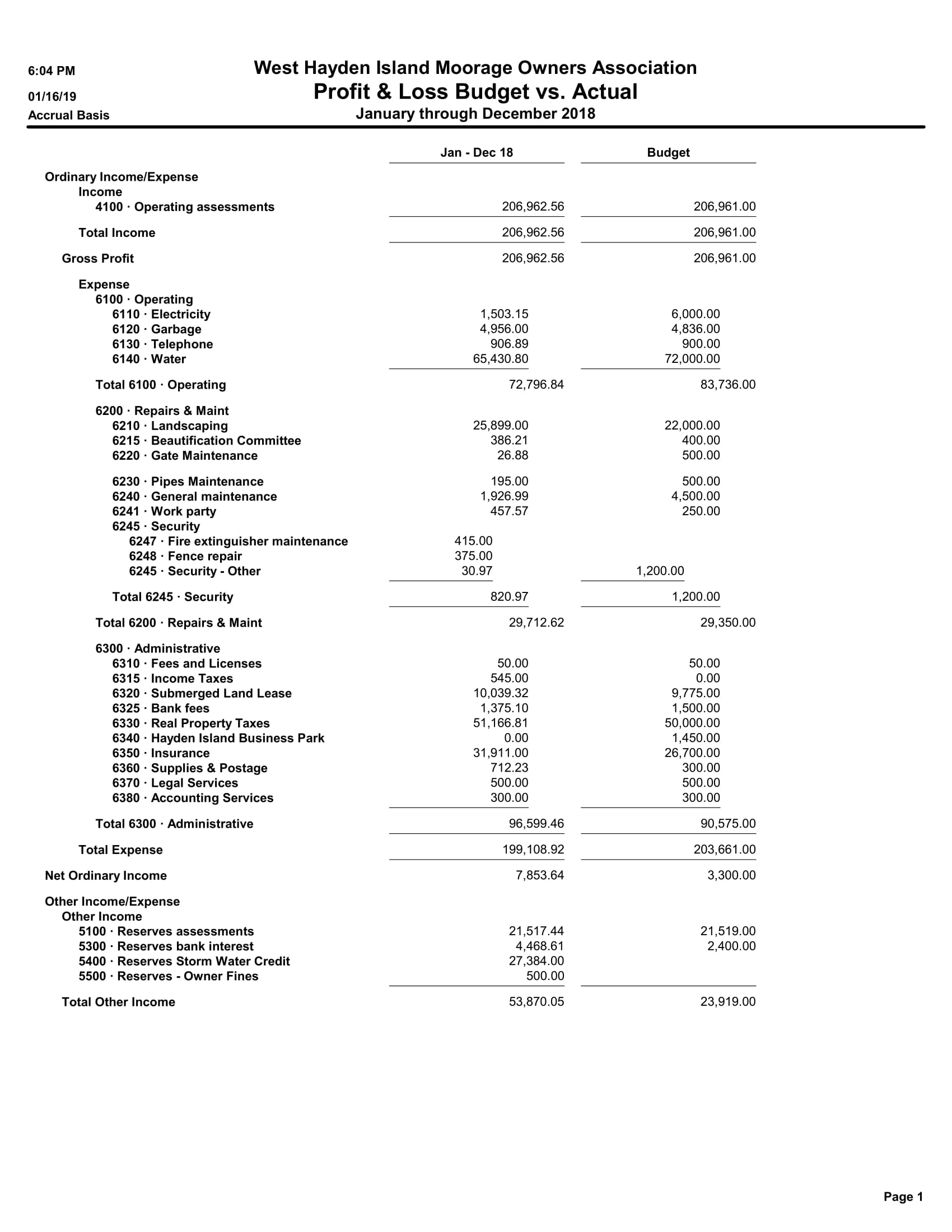

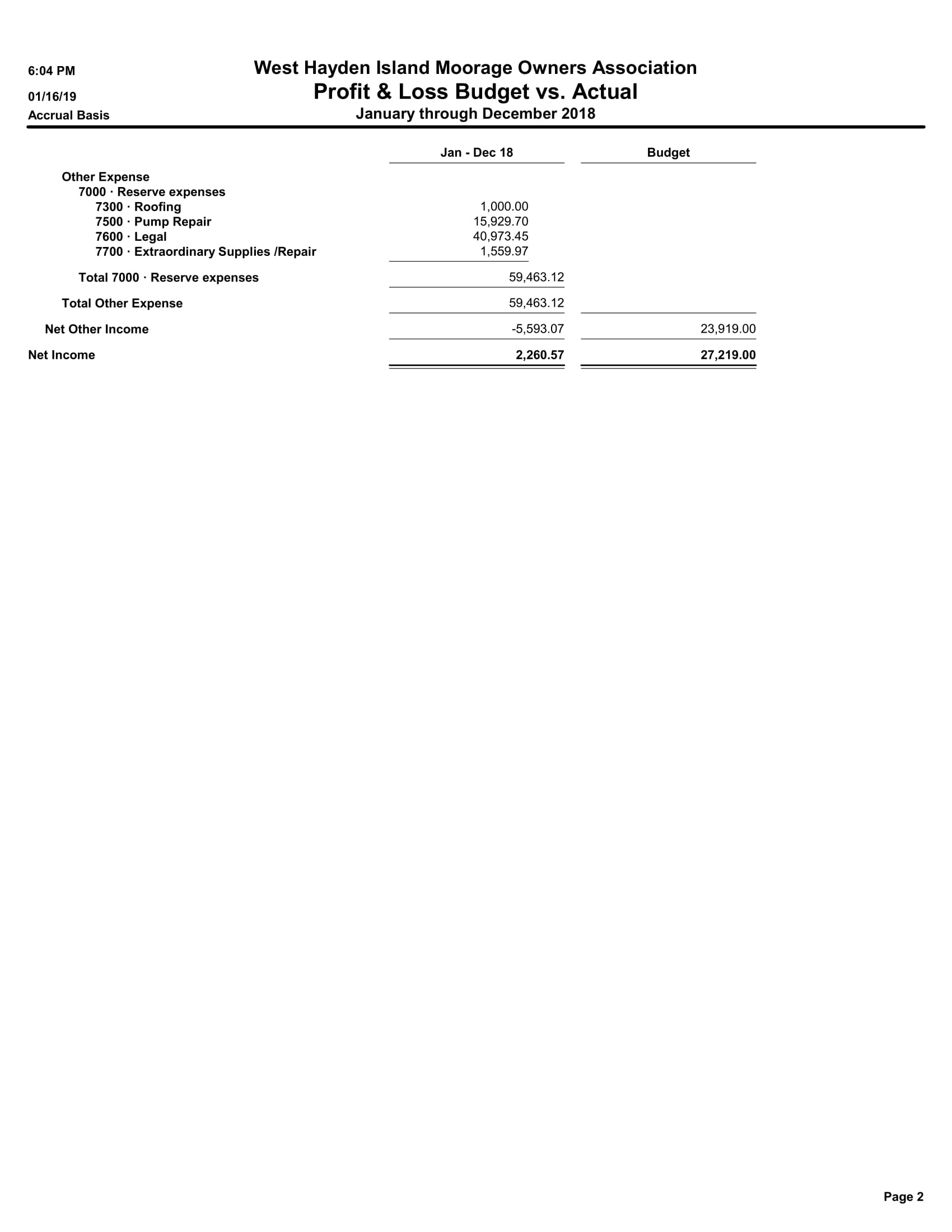

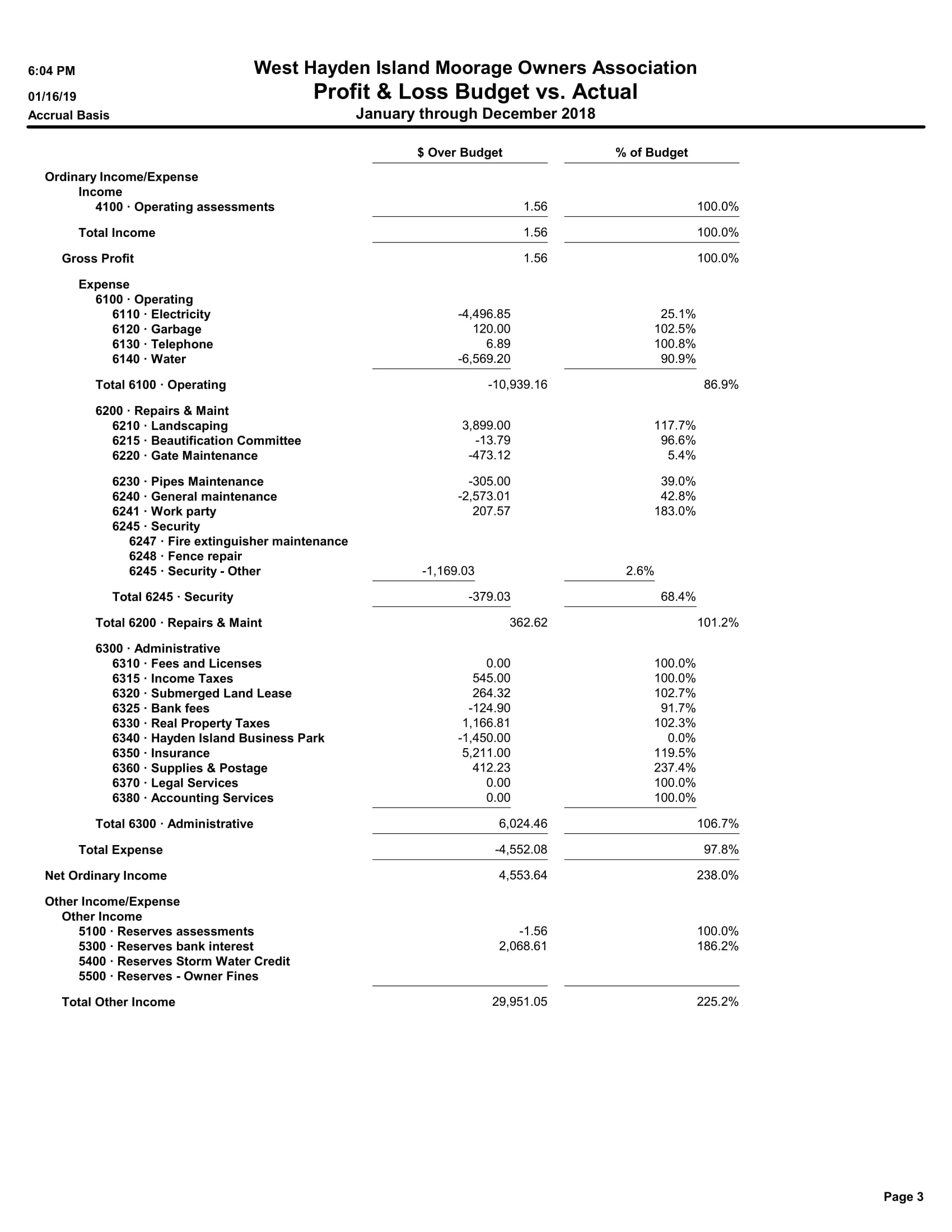

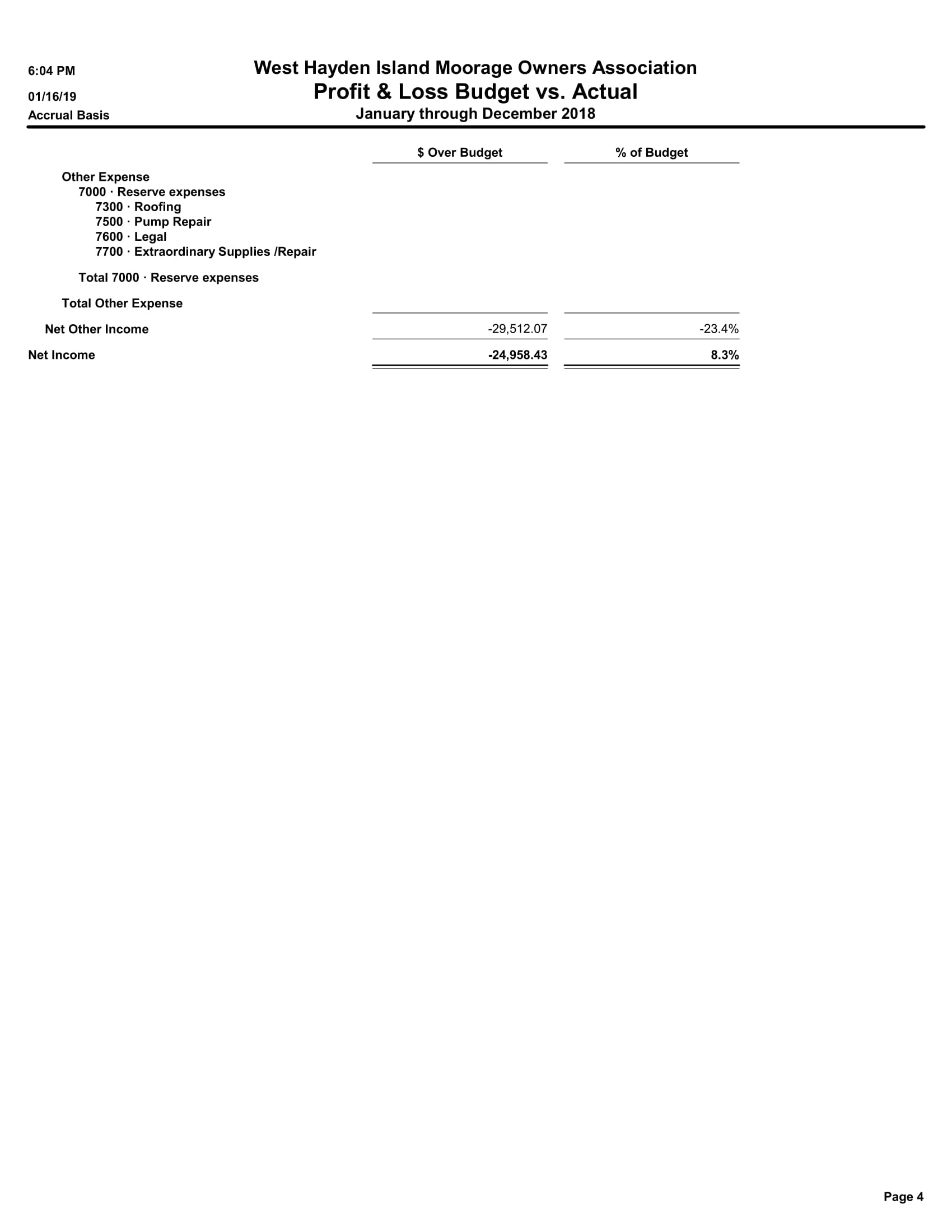

2018

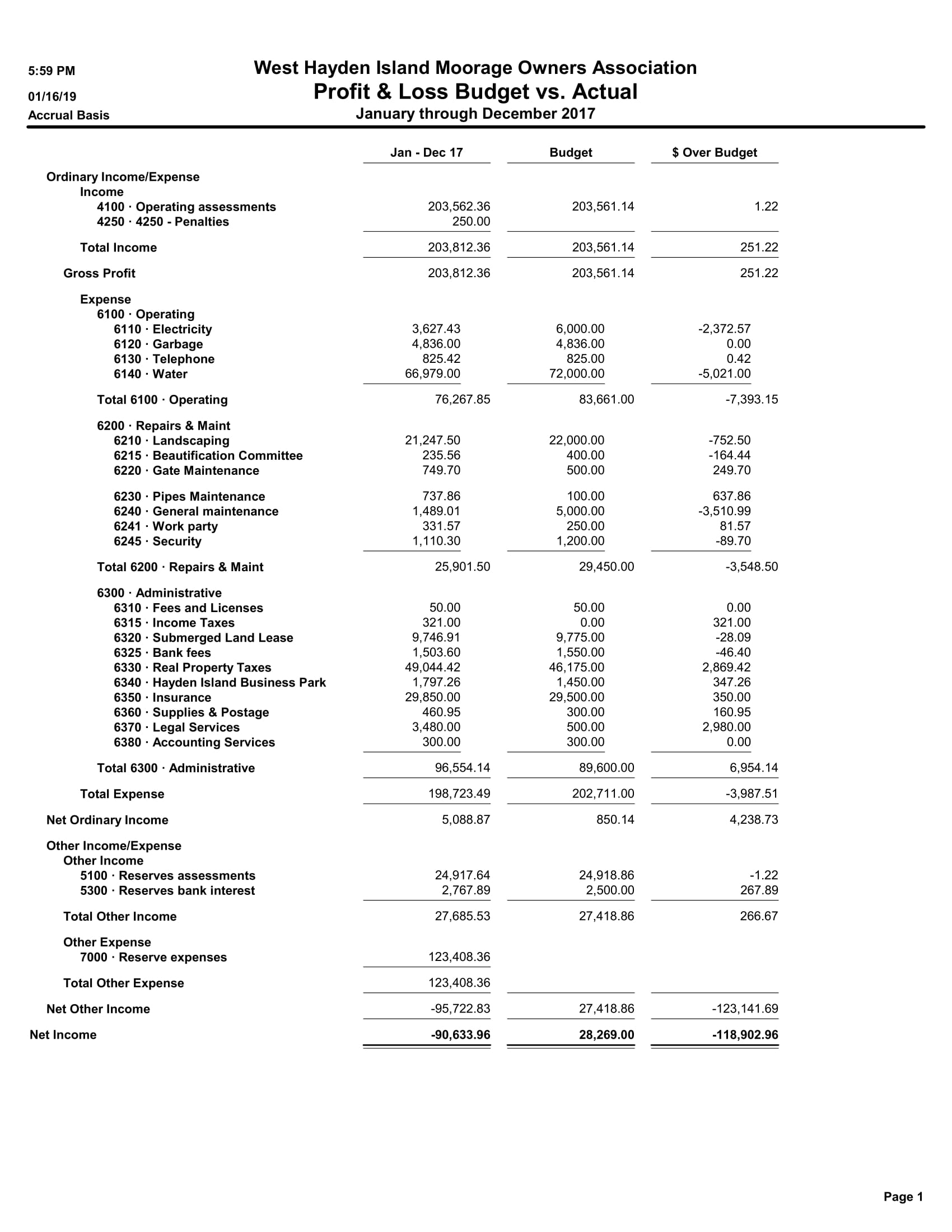

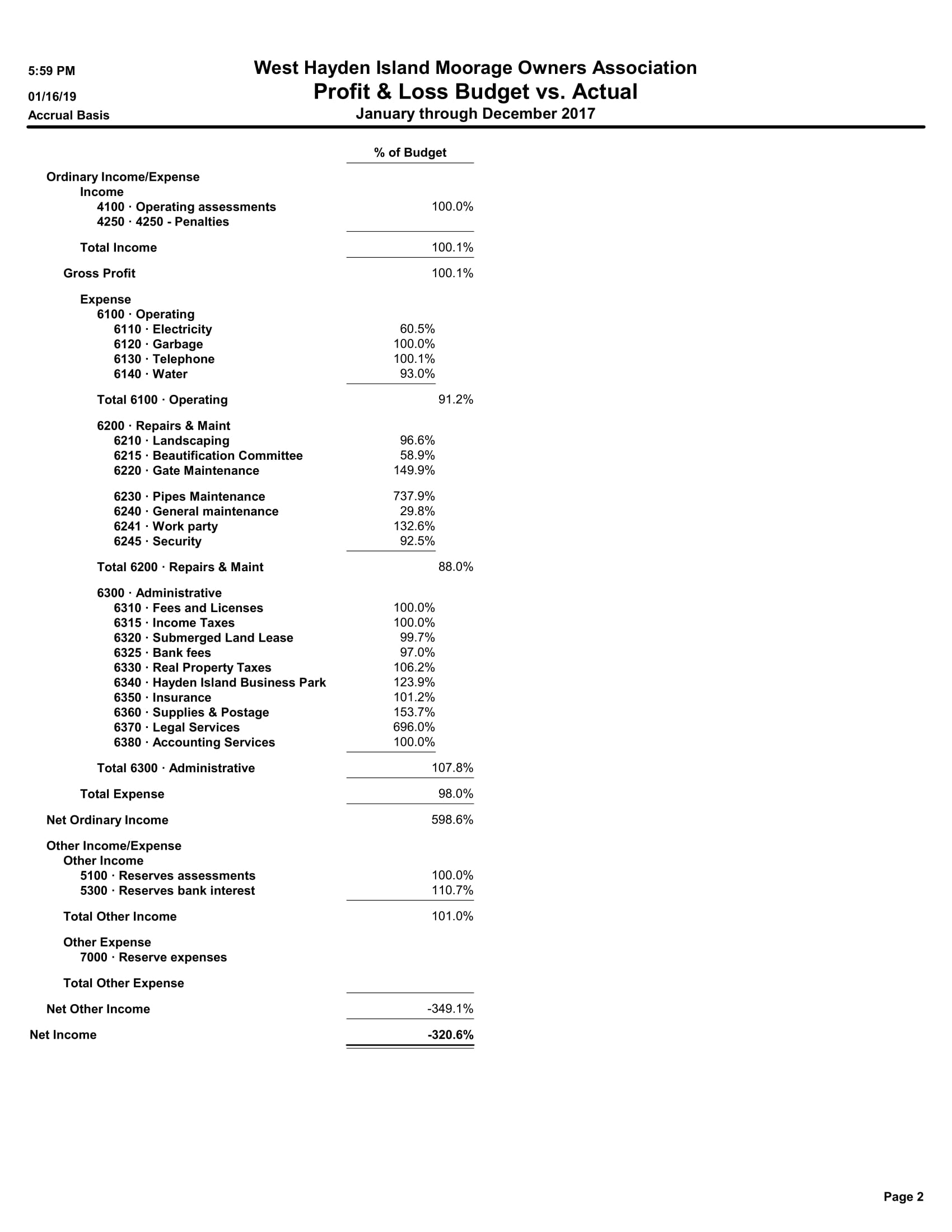

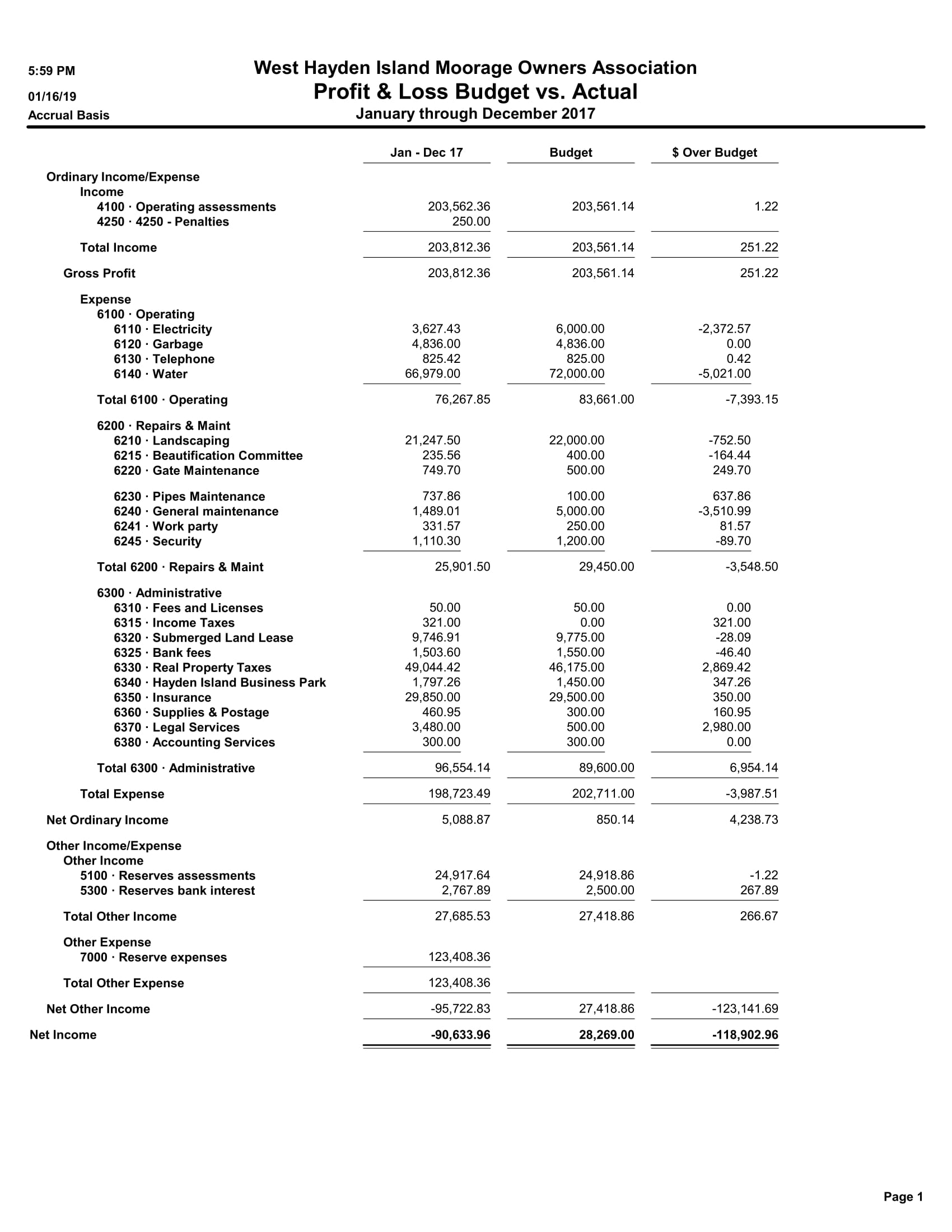

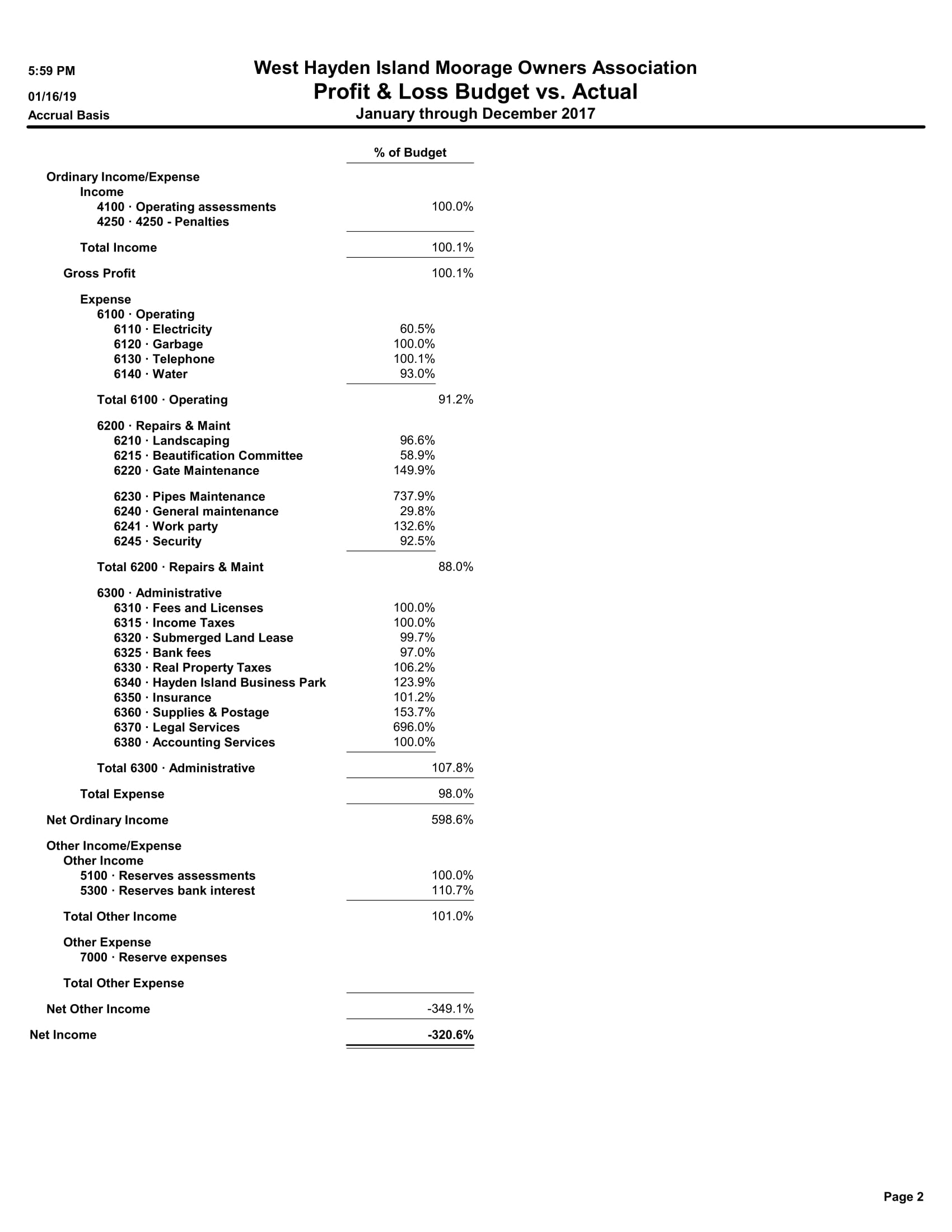

2017

2016

2015

2014

West Hayden Island Moorage Owners Association

Profit & Loss vs. Actual 2014

|

Ordinary Income/Expense |

Actual | Budget | $ Over Budget | % of Budget | 2015Budget | ||

|

Income |

|||||||

|

4100-Operating assessments |

189879.12 | 189,880.00 | -.88 | 100.0% | 193,626.05 | ||

| 4200-Late Fees | 10.05 | ||||||

| 4250-Penalties | -106.11 | ||||||

|

4400-Miscelaneous revenue |

.00 | ||||||

|

Total Income |

189,783.06 | 189880.00 | -96.94 | 99.9% | 193,626.05 | ||

|

|

|

|

|

|

|||

|

Expense |

|||||||

|

6100-Operating |

|||||||

| 6110-Electricity | 5,435.90 | 4,600.00 | 835.90 | 118.2% | 6,375.00 | ||

| 6120-Garbage | 4,833.00 | 5,000.00 | -167.00 | 96.7% | 4,836.00 | ||

| 6130-Telephone | 652.48 | 700 | -47.52 | 93.2% | 660.00 | ||

| 6140-Water | 71,295.42 | 54,000.00 | 17,295.42 | 132.0% | 60,000.00 | ||

|

Total Operating Expense |

92,216.80 | 64,300.00 | 17,916.80 | 127.9% | 71,871.00 | ||

|

6200-Repairs & Maint. |

|||||||

| 6210-Landscaping | 21,200.03 | 20,000.00 | 1200.03 | 106.0% | 22,500.00 | ||

| 6215-Beautification Committee | 468.83 | 1000 | -530.17 | 47.0% | 600.00 | ||

| 6220-Gate Maintenance | 490.00 | 1,250.00 | -760.00 | 39.2% | 1,000.00 | ||

| 6230-Pipes Maintenance | 844.65 | 650.00 | 194.65 | 129.9% | 2000.00 | ||

| 6240-General Maintenance | 5,107.76 | 4,000,00 | 1,107.76 | 127.7% | 5,000.00 | ||

| 6241-Work Party | 250.00 | 250.00 | 0.00 | 100.0% | 250.00 | ||

| 6245-Security | 1,200.00 | ||||||

| 6247-Fire extinguisher Maint. | 178.50 | ||||||

| 6248-Fence Repair | |||||||

| 6245-Security other | 1,359.00 | 900.00 | 459.00 | 151.0% | |||

|

Total Security |

1,537.50 | 900.00 | 637.50 | 170.8% | 1,200.00 | ||

|

Total Repairs & Maint. |

29,899.77 | 28,050.00 | 1,849.77 | 106.6% | 32,550.00 | ||

|

6300- Administrative |

|||||||

|

6310-Fees and Licenses |

50.00 | 50.00 | 0.00 | 100.0% | 50.00 | ||

|

6315-Income Tax |

0.00 | 700.00 | -700.00 | 0.00% | 0.00 | ||

|

6320-Submerged Land Lease |

8,927.72 | 8,900.00 | -2.28 | 100.0% | 9,195.00 | ||

|

6325-Bank fees |

1,445.15 | 1,450.00 | -4.85 | 99.7% | 1,422.0 | ||

|

6330-Real Property Taxes * |

43,531.49 | 44,000.00 | -468.51 | 105.3% | 44,400.00 | ||

|

6340-Hayden Island Business Park |

1,162.50 | 1,600.00 | -437.50 | 72.7% | 1,588.00 | ||

|

6350-Insurance |

29,852.00 | 39,500.00 | -9,648.00 | 75.6% | 31,500.00 | ||

|

6360-Supplies and Postage |

1,298.70 | 250.00 | 1,048.70 | -519.5% | 250.00 | ||

|

6370-Legal Services |

0.00 | 750.00 | -750.00 | 0.0% | 500.00 | ||

|

6380-Accounting Services |

300.00 | 300.00 | 0.00 | 100.00% | 300.00 | ||

|

Total Administration |

86,567.56 | 97530.00 | -10,962.44 | 104.6% | 89.205.05 | ||

|

Total Expenses |

198,684.13 | 189,880.00 | 8,804.13 | 109.3% | 193.626.05 | ||

|

NET ORDINARY INCOME |

-8,901.07 | 0.00 | -8,901.07 | 100.0% | |||

|

Other Income and Expenses |

|||||||

|

Other Income |

|||||||

|

5100-Reserve assessments |

15,079.68 | 15,080.00 | -.32 | 100.0% | 30,413.95 | ||

|

5300-Reserve bank interest |

660.92 | 1,500.00 | -839.08 | 44.1% | 675.00 | ||

|

Total Other Income |

15,740.60 | 16,580.00 | -839.40 | 94.9% | 31,088.95 | ||

|

Other expenses |

|||||||

|

7000-Reserve expenses |

21,209.88 | ||||||

|

Total Other Expenses |

21,209.88 | ||||||

|

NET OTHER INCOME |

-5,469.28 | 16,580.00 | -22,049.28 | -33.0% | 31,088.95 | ||

|

TOTAL NET INCOME |

-14,370.35 | 16,580.00 | -30,950.35 | -88.7 | 31,088.95 |

* Property Taxes per slip is 763.71

December 31, 2014 Balance Sheet

| Dec 31, 2014 | |||||

|

ASSETS |

|||||

|

Current Assets |

|||||

|

Checking/Savings |

|||||

|

1145 · US Bank |

10.13 | ||||

|

1150 · Schwab |

408,605.62 | ||||

|

Total Checking/Savings |

408,615.75 | ||||

| Total Current Assets | 408,615.75 | ||||

|

Fixed Assets |

|||||

|

2000 · Land and Bldgs |

3,417,850.00 | ||||

|

Total Fixed Assets |

3,417,850.00 | ||||

|

TOTAL ASSETS |

3,840,835.80 | ||||

|

LIABILITIES & EQUITY |

|||||

|

Liabilities |

0.00 |

||||

|

Equity |

|||||

|

3200 · Reserves fund balance |

299,739.58 | ||||

|

3400 · Contribution to capital |

3,447,622.21 | ||||

|

3500 · Retained Earnings |

93,474.31 | ||||

|

Net Income |

-14,370.35 | ||||

|

Total Equity |

3,826,465.75 | ||||

|

TOTAL LIABILITIES & EQUITY |

3,826,465.75 | ||||

2013

West Hayden Island Moorage Owners Association

Profit & Loss vs. Actual 2013

|

Ordinary Income/Expense |

Actual | Budget | $ Over Budget | % of Budget | 2014 Budget | ||

|

Income |

|||||||

|

4100-Operating assessments |

187,955.34 | 171,900 | 16,055.34 | 109.3% | |||

| 4250-Penalties | 600.00 | ||||||

|

4400-Miscelaneous revenue |

157.22 | ||||||

|

Total Income |

188,712.56 | 171,900.00 | 16,812.56 | 109.3% | 189,880.00 | ||

|

|

|

|

|

|

|||

|

Expense |

|||||||

|

6100-Operating |

|||||||

| 6110-Electricity | 4,542.47 | 4,500.00 | 42.47 | 100.9% | 4,600.00 | ||

| 6120-Garbage | 6,323.79 | 6,800.00 | -476.21 | 93.0% | 5,000.00 | ||

| 6130-Telephone | 662.92 | 600.00 | 62.92 | 110.5% | 700.00 | ||

| 6140-Water | 52,769.38 | 42,000.00 | 10,769.38 | 125.6% | 54,000.00 | ||

|

Total Operating Expense |

64,298.56 | 53,900.00 | 10,398.65 | 119.3% | 64,300.00 | ||

|

6200-Repairs & Maint. |

|||||||

| 6210-Landscaping | 20,421.50 | 20,000.00 | 421.50 | 102.1% | 20,000.00 | ||

| 6215-Beautification Committee | 519.35 | 1500.00 | -980.65 | 34.8% | 1,000.00 | ||

| 6220-Gate Maintenance | 654.00 | 1,250.00 | -596.00 | 52.3% | 1,250.00 | ||

| 6230-Pipes Maintenance | 866.77 | 500.00 | 366.77 | 173.4% | 650.00 | ||

| 6240-General Maintenance | 5,729.49 | 3,500.00 | 2,229.49 | 163.7% | 4,000.00 | ||

| 6241-Work Party | 220.36 | 600.00 | -379.64 | 36.7% | 250.00 | ||

| 6245-Security | |||||||

| 6247-Fire extinguisher Maint. |

216.00 |

||||||

| 6248-Fence Repair |

364.00 |

||||||

| 6245-Security other |

789.70 |

800.00 | 10.30 | 98.7% | |||

|

Total Security |

1,369.70 | 800.00 | 569.70 | 171.2% | 900.00 | ||

|

Total Repairs & Maint. |

29,781.17 |

28,150.00 | 1,631.17 | 105.8% | 28,050.00 | ||

|

6300- Administrative |

|||||||

|

6310-Fees and Licenses |

50.00 | 50.00 | 0.00 | 100.0% | 50.00 | ||

|

6315-Income Tax |

684.00 | 700.00 | -16.00 | 97.7% | 700.00 | ||

|

6320-Submerged Land Lease |

8,667.69 | 8,650.00 | 17.69 | 100.2% | 8,930.00 | ||

|

6325-Bank fees |

1,524.75 | 1,450.00 | 74.75 | 105.2% | 1,450.00 | ||

|

6330-Real Property Taxes * |

42,767.90 | 40,600.00 | 2,167.90 | 105.3% | 44,000.00 | ||

|

6340-Hayden Island Business Park |

378.80 | 2,100.00 | -1,721.20 | 18.0% | 1,600.00 | ||

|

6350-Insurance |

39,326.00 | 35,000.00 | 4,326.00 | 112.4% | 39,500.00 | ||

|

6360-Supplies and Postage |

176.47 | 250.00 | -73.53 | 70.6% | 250.00 | ||

|

6370-Legal Services |

0.00 | 750.00 | -750.00 | 0.0% | 750.00 | ||

|

6380-Accounting Services |

300.00 | 300.00 | 0.00 | 100.00% | 300.00 | ||

|

Total Administration |

93,875.61 | 89,850.00 | 4,025.61 | 104.5% | 97,530.00 | ||

|

Total Expenses |

187,955.34 | 171,900.00 | 16,055.34 | 109.3% | 189,880.00 | ||

|

NET ORDINARY INCOME |

757.22 | 0.00 | 757.22 | 100.0% | |||

|

Other Income and Expenses |

|||||||

|

Other Income |

|||||||

|

5100-Reserve assessments |

17,004.36 | 33,060.00 | -16,055.64 | 51.4% | 15000.00 | ||

|

5300-Reserve bank interest |

1,326.22 | 4,000.00 | -2,673.78 | 33.2% | 1500.00 | ||

|

Total Other Income |

18,330.58 | 37,060.00 | -18,729.42 | 49.5% | 16500.00 | ||

|

Other expenses |

|||||||

|

7000-Reserve expenses |

11,348.75 | ||||||

|

Total Other Expenses |

11,348.75 | ||||||

|

NET OTHER INCOME |

6,981.83 | 37,060.00 | -30,078.17 | 18.8% | |||

|

TOTAL NET INCOME |

7,739.05 | 37,060.00 | -30,078.17 |

* Property Taxes per slip is 763.71

December 31, 2013 Balance Sheet

| Dec 31, 2013 | |||||

|

ASSETS |

|||||

|

Current Assets |

|||||

|

Checking/Savings |

|||||

|

1145 · US Bank |

1.07 | ||||

|

1150 · Schwab |

422,472.81 | ||||

|

Total Checking/Savings |

422,473.88 | ||||

| Accounts Receivable | |||||

|

1200 – Assessments Receivable |

511.92 | ||||

| Total Accounts Receivable | 511.92 | ||||

|

|

422,985.80 |

||||

|

Fixed Assets |

|||||

|

2000 · Land and Bldgs |

3,417,850.00 |

||||

|

Total Fixed Assets |

3,417,850.00 |

||||

|

TOTAL ASSETS |

3,840,835.80 | ||||

|

LIABILITIES & EQUITY |

|||||

|

Liabilities |

0.00 |

||||

|

Equity |

|||||

|

3200 · Reserves fund balance |

299,739.58 |

||||

|

3400 · Contribution to capital |

3,447,622.21 |

||||

|

3500 · Retained Earnings |

85,734.96 |

||||

|

Net Income |

7,739.05 | ||||

|

Total Equity |

3,840,835.80 |

||||

|

TOTAL LIABILITIES & EQUITY |

3,840,835.80 | ||||

2012

West Hayden Island Moorage Owners Association

Profit & Loss vs. Actual 2012

| Actual | Budget | $ Over Budget | % of Budget | |

| Ordinary Income/Expense | ||||

| Income | ||||

| 4100-Operating assessments | 172,979.52 | 172,775.00 | -3.80 | 100.0% |

| 4400-Miscelaneous revenue | 205.00 | |||

| Total Income | 172976.20 | 172775.00 | 201.20 | 100.1% |

| Expense | ||||

| 6100-Operating | ||||

| 6110-Electricity | 4298.01 | 4500.00 | -201.20 | 95.2% |

| 6120-Garbage | 6708.90 | 6500.00 | 208.90 | 103.2% |

| 6130-Telephone | 628.12 | 600.00 | 28.12 | 104.7% |

| 6140-Water | 40577.65 | 45000.00 | -4422.35 | 90.2% |

| Total Operating Expense | 52212.68 | 56800.00 | -4422.35 | 92.2% |

| 6200-Repairs & Maint. | ||||

| 6210-Landscaping | 19802.00 | 20000.00 | -198.00 | 99.0% |

| 6215-Beautification Committee | 1250.58 | 1500.00 | -249.42 | 83.4% |

| 6220-Gate Maintenance | 1979.00 | 1000.00 | 979.00 | 197.9% |

| 6230-Pipes Maintenance | 195.00 | 700.00 | -505.00 | 27.9% |

| 6240-General Maintenance | 3353.39 | 4000.00 | -646.61 | 83.8% |

| 6241-Work Party | 203.42 | 600.00 | -396.58 | 33.9% |

| 6245-Security | ||||

| 6247-Fire extinguisher Maintenance | 337.50 | |||

| 6245-Security other | 150.00 | 750.00 | -600.00 | |

| Total Security | 487.50 | 750.00 | -262.50 | 65.0% |

| Total Repairs & Maint. | 27270.89 | 28550.00 | -1279.11 | 95.5% |

| 6300- Administrative | ||||

| 6310-Fees and Licenses | 50.00 | 100.00 | -50.00 | 50.0% |

| 6315-Income Tax | 699.00 | 1750.00 | -1051.00 | 39.9% |

| 6320-Submerged Land Lease | 8415.23 | 8200.00 | 215.23 | 102.6% |

| 6325-Bank fees | 1329.80 | 1450.00 | -120.20 | 91.7% |

| 6330-Real Property Taxes | 39073.47 | 38500.00 | 573.47 | 101.5% |

| 6340-Hayden Island Business Park | 2028.05 | 1300.00 | 728.06 | 156.0% |

| 6350-Insurance | 36608.45 | 35000 | 1608.45 | 104.6% |

| 6360-Supplies and Postage | 1008.87 | 250.00 | 756.67 | 402.7% |

| 6370-Legal Services | 0.00 | 750.00 | -750.00 | 0.00 |

| 6380-Accounting Services | 300.00 | 325.00 | -25.00 | 92.3% |

| Total 6300-Administration | 89510.88 | 87625.00 | 1885.88 | 102.2 |

| Total Expenses | 168994.45 | 172775.00 | -3780.55 | 97.8% |

| NET ORDINARY INCOME | 3981.75 | 0.00 | 3981.75 | |

| Other Income and Expenses | ||||

| Other Income | ||||

| 5100-Reserve assessments | 32188.80 | 32185.18 | 3.62 | 100.0% |

| 5300-Reserve bank interest | 4133.80 | 4000.00 | 133.80 | 103.3% |

| Total Other Income | 36322.60 | 36185.18 | 137.42 | 100.4% |

| Other expenses | ||||

| 7000-Reserve expenses | 3807.45 | |||

| Total Other Expenses | 3807.45 | |||

|

NET OTHER INCOME |

32515.15 | 38185.18 | -3670.03 | 89.9% |

|

TOTAL NET INCOME |

36496.80 | 36185.18 | 311.72 | 100.9% |

* Primarily for the driveway blacktop as planned

| Dec 31, 12 | |||||

| ASSETS | |||||

| Current Assets | |||||

| Checking/Savings | |||||

| 1145 · US Bank | 2,972.66 | ||||

| 1150 · Schwab | 413,024.09 | ||||

| Total Checking/Savings | 415,996.75 | ||||

| Total Current Assets | 415,996.75 | ||||

| Fixed Assets | |||||

| 2000 · Land and Bldgs | 3,417,850.00 | ||||

| Total Fixed Assets | 3,417,850.00 | ||||

| TOTAL ASSETS | 3,833,846.75 | ||||

| LIABILITIES & EQUITY | |||||

| Liabilities | |||||

| Current Liabilities | |||||

| Other Current Liabilities | |||||

| 2350 · Accrued liabilties | 750.00 | ||||

| Total Other Current Liabilities | 750.00 | ||||

| Total Current Liabilities | 750.00 | ||||

| Total Liabilities | 750.00 | ||||

| Equity | |||||

| 3200 · Reserves fund balance | 299,739.58 | ||||

| 3400 · Contribution to capital | 3,447,622.21 | ||||

| 3500 · Retained Earnings | 49,238.06 | ||||

| Net Income | 36,496.90 | ||||

| Total Equity | 3,833,096.75 | ||||

| TOTAL LIABILITIES & EQUITY | 3,833,846.75 | ||||

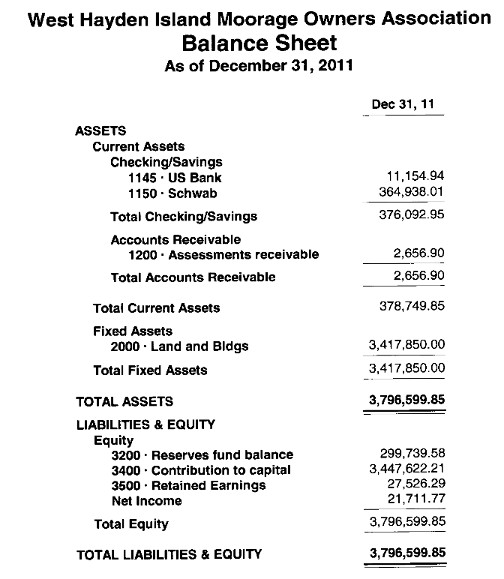

2011

West Hayden Island Moorage Owners Association

Profit & Loss vs. Actual 2011

| Actual | Budget | $ Over Budget | % of Budget | |

| Ordinary Income/Expense | ||||

| Income | ||||

| 4100-Operating assessments | 172,979.52 | 172,980.00 | -0.48 | 100.0% |

| 4200-Late Fees | 6.55 | |||

| 4250-Penalties | 100.00 | |||

| 4400-Miscelaneous revenue | 120.16 | |||

| Total Income | 172,965.91 | 172,980.00 | -14.09 | 100.0% |

| Expense | ||||

| 6100-Operating | ||||

| 6110-Electricity | 4,503.91 | 4455 | 48.91 | 101.1% |

| 6120-Garbage | 6,440.00 | 7,020.00 | -5,800 | 91.7% |

| 6130-Telephone | 599.38 | 600.00 | -0.62 | 99.9% |

| 6140-Water | 41,863.30 | 46,600.00 | -4,736.70 | 89.8% |

| Total Operating Expense | 53,406.59 | 58,675.00 | -5,268.41 | 91.0% |

| 6200-Repairs & Maint. | ||||

| 6210-Landscaping | 20,758.05 | 18,500.00 | 2,258.05 | 112.2% |

| 6215-Beautification Committee | 795.00 | 1,500.00 | -704.35 | 53.0% |

| 6220-Gate Maintenance | 438.00 | 1,375.00 | -937.00 | 31.9% |

| 6230-Pipes Maintenance | 1,542.98 | 1,500.00 | 42.98 | 102.9% |

| 6240-General Maintenance | 4,251.94 | 6,000.00 | -1,748.06 | 70.9% |

| 6241-Work Party | 0.00 | 600.00 | -600.00 | 0.0% |

| 6245-Security | ||||

| 6247-Fire extinguisher Maintenance | 343.00 | |||

| 6248-Fence repair | 292.00 | |||

| 6245-Security other | 690.00 | 720.00 | -30.00 | 95.8% |

| Total Security | 1,425.00 | 720.00 | 705.00 | 197.9% |

| Total Repairs & Maint. | 29,211.62 | 30,195.00 | -983.38 | 96.7% |

| 6300- Administrative | ||||

| 6310-Fees and Licenses | 50.00 | 150.00 | -100.00 | 33.3% |

| 6315-Income Tax | 1,762.00 | 550.00 | 1,212.00 | 320.4% |

| 6320-Submerged Land Lease | 8,153.28 | 8,000.00 | 153.28 | 101.9% |

| 6325-Bank fees | 1,423.05 | 1,500.00 | -76.95 | 94.9% |

| 6330-Real Property Taxes | 37,936.14 | 37,300.00 | 636.14 | 101.7% |

| 6340-Hayden Island Business Park | 1,963.16 | 1,200.00 | 763.16 | 163.6% |

| 6350-Insurance | 34,411.00 | 35,000.00 | -589.00 | 98.3% |

| 6360-Supplies and Postage | 226.73 | 50.00 | 176.73 | 453.5% |

| 6370-Legal Services | 778.25 | 360.00 | 418.25 | 216.2% |

| 6380-Accounting Services | 275.00 | |||

| Total 6300-Administration | 86,978.61 | 84110.00 | 2868.61 | 103.4% |

| Total Expenses | 169,596.82 | 172980.00 | -3383.18 | 98.0% |

| NET ORDINARY INCOME | 3,369.09 | 0.00 | 3,369.09 | |

| Other Income and Expenses | ||||

| Other Income | ||||

| 5100-Reserve assessments | 31,980.48 | 31,980.00 | .48 | 100.0% |

| 5300-Reserve bank interest | 4,003.86 | 6,600 | -2,596.14 | 60.7% |

| Total Other Income | 35,984.34 | 38,580.00 | -2,595.66 | 93.3% |

| Other expenses | ||||

| 7000-Reserve expenses | 17,641.66* | |||

| Total Other Expenses | 17,641.66 | 38,580.00 | -20,237.32 | |

|

NET OTHER INCOME |

18,342.68 |

38,580.00 |

-16,868.23 |

56.3% |

|

TOTAL NET INCOME |

21,711.77 |

38,580.00 |

-16,868.23 |

56.3% |

* Primarily for the driveway blacktop as planned

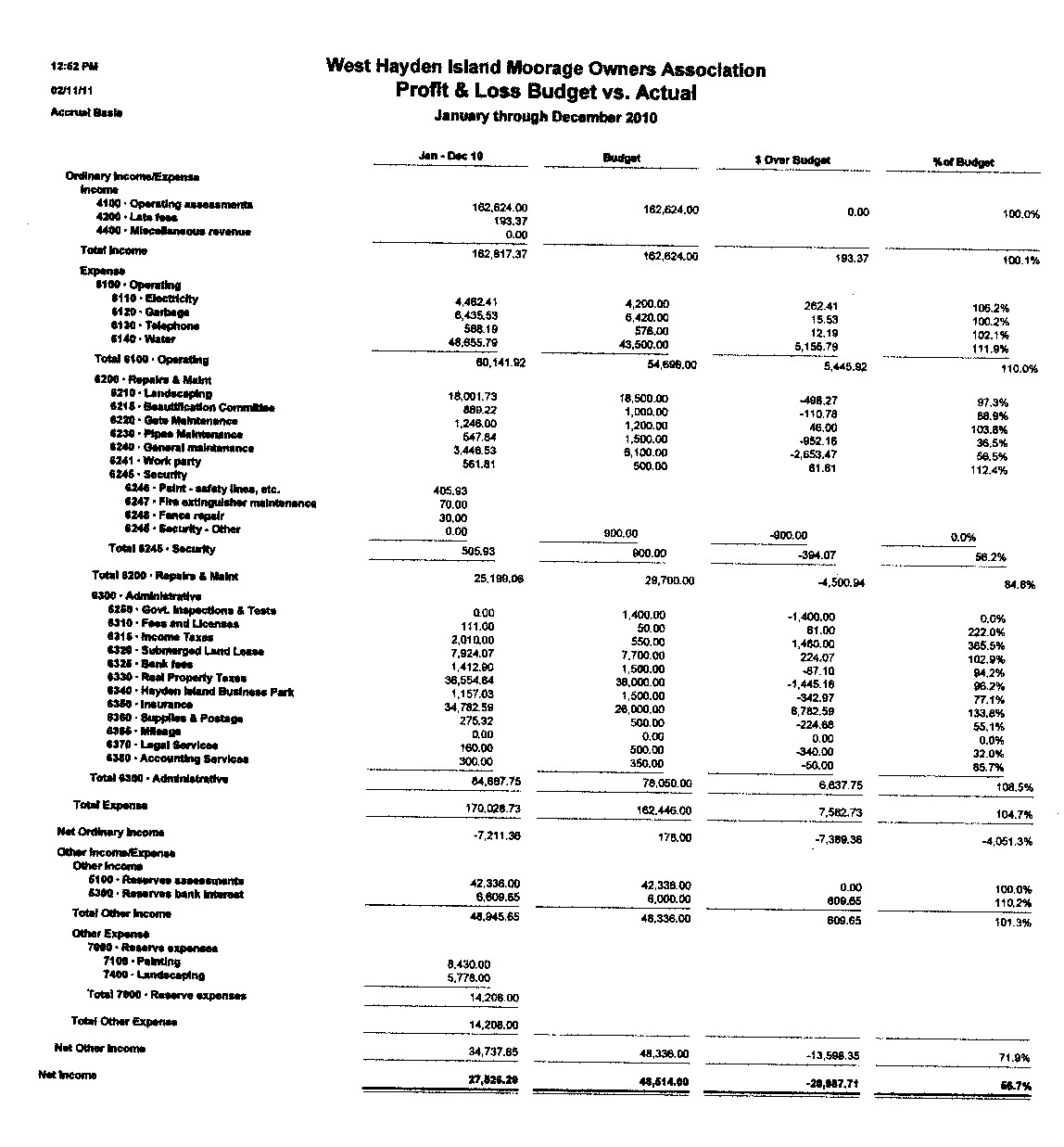

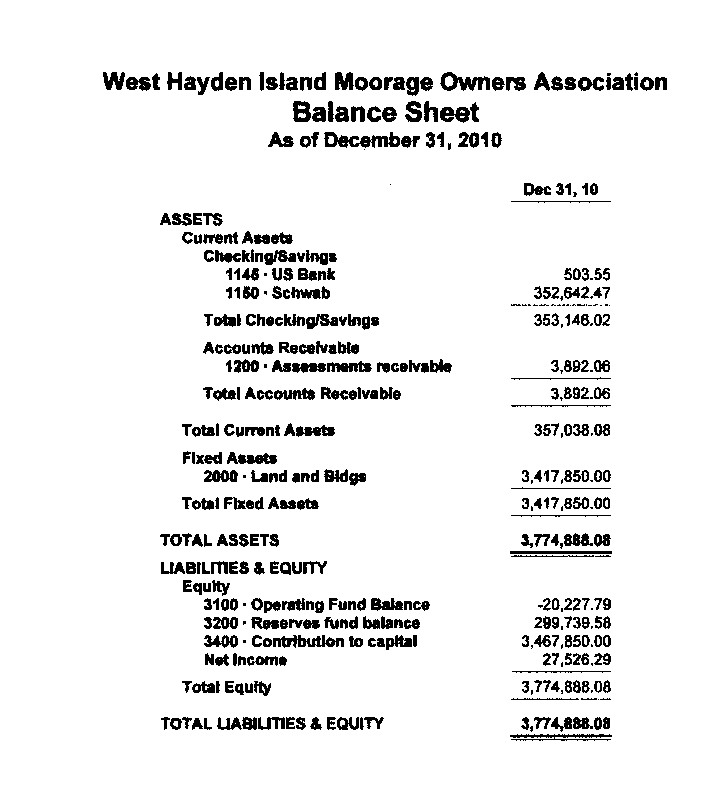

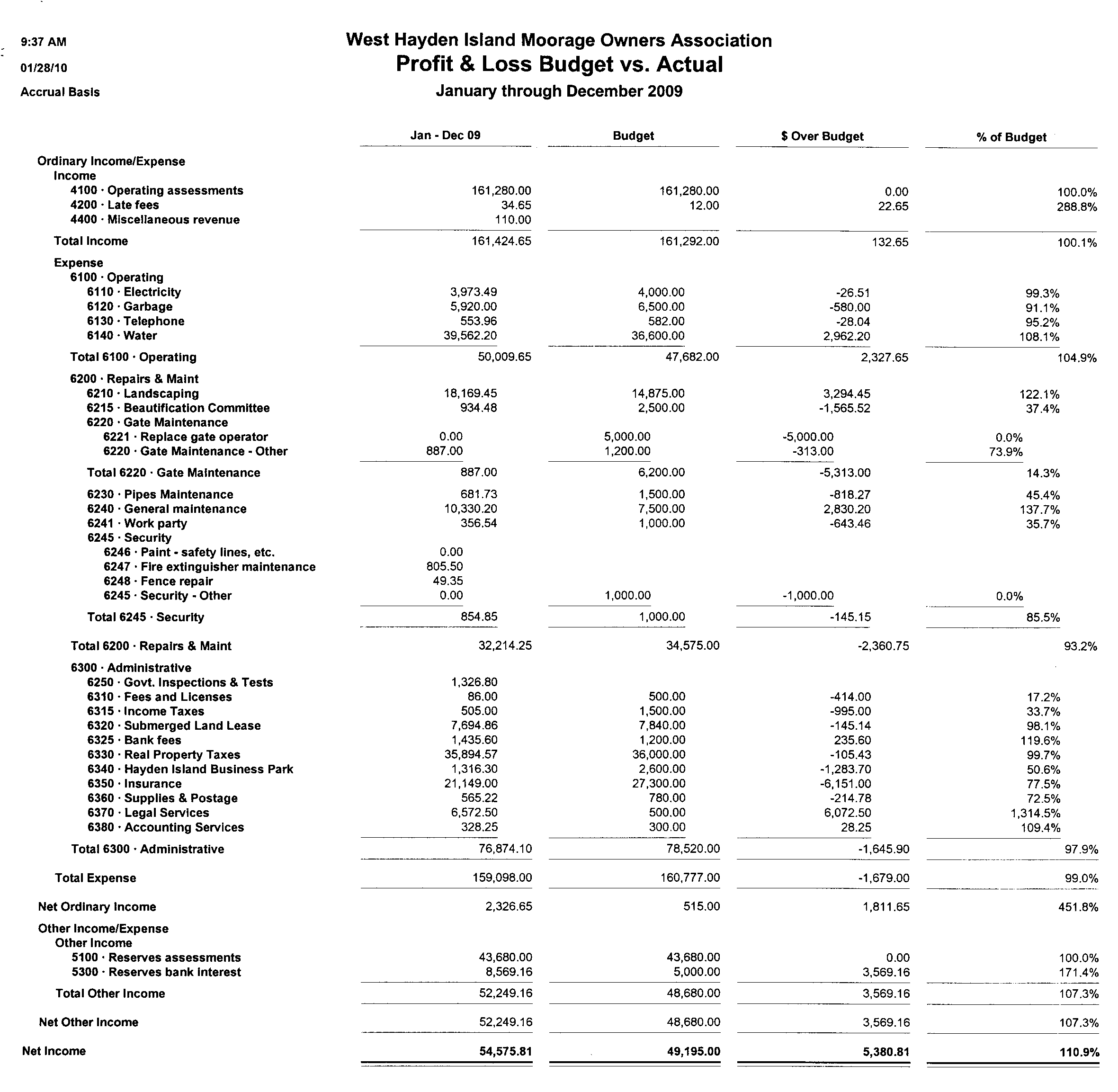

2010

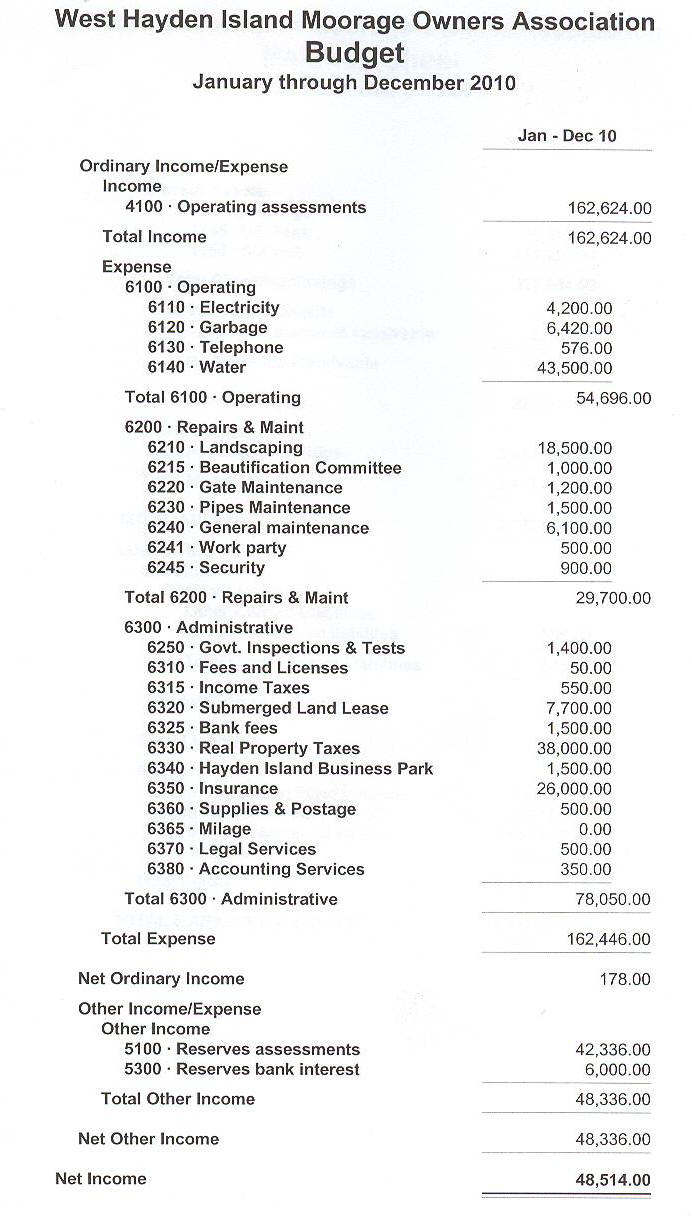

2009

2008

Income Statement and Budget (Balance Sheet Below)

| Jan – Dec 07 | Budget | $ Over Budget | % of Budget | |||||||||

|

|

Ordinary Income/Expense |

|||||||||||

|

|

Income |

|||||||||||

|

|

4100 · Operating assessments |

143,808.00 |

143,808.00 |

0.00 |

100.0% |

|||||||

|

|

4200 · Late fees |

34.36 |

0.00 |

34.36 |

100.0% |

|||||||

|

|

4250 · 4250 – Penalties |

25.00 |

||||||||||

|

|

4300 · Operating bank interest |

0.00 |

0.00 |

0.00 |

0.0% |

|||||||

|

|

4400 · Miscellaneous revenue |

730.00 |

0.00 |

730.00 |

100.0% |

|||||||

|

|

Total Income |

144,597.36 |

143,808.00 |

789.36 |

100.55% |

|||||||

|

|

Expense |

|||||||||||

|

|

6100 · Operating | |||||||||||

|

|

6110 · Electricity |

3,676.70 |

3,300.00 |

376.70 |

111.42% |

|||||||

|

|

6120 · Garbage |

7,336.36 |

8,400.00 |

-1,063.64 |

87.34% |

|||||||

|

|

6130 · Telephone |

542.71 |

516.00 |

26.71 |

105.18% |

|||||||

|

|

6140 · Water |

24,642.17 |

26,004.00 |

-1,361.83 |

94.76% |

|||||||

|

|

Total 6100 · Operating |

36,197.94 |

38,220.00 |

-2,022.06 |

94.71% |

|||||||

|

|

6200 · Repairs & Maint | |||||||||||

|

|

6210 · Landscaping |

9,735.90 |

12,600.00 |

-2,864.10 |

77.27% |

|||||||

|

|

6220 · Gate Maintenance | |||||||||||

|

|

6221 · Replace gate operator |

0.00 |

5,000.00 |

-5,000.00 |

0.0% |

|||||||

|

|

6220 · Gate Maintenance – Other |

182.00 |

1,800.00 |

-1,618.00 |

10.11% |

|||||||

|

|

Total 6220 · Gate Maintenance |

182.00 |

6,800.00 |

-6,618.00 |

2.68% |

|||||||

|

|

6230 · Pipes Maintenance |

713.40 |

600.00 |

113.40 |

118.9% |

|||||||

|

|

6240 · General maintenance |

19,626.16 |

12,000.00 |

7,626.16 |

163.55% |

|||||||

|

|

6245 · Security | |||||||||||

|

|

6246 · Paint – safety lines, etc. |

443.24 |

450.00 |

-6.76 |

98.5% |

|||||||

|

|

6247 · Fire extinguisher maintenance |

350.00 |

500.00 |

-150.00 |

70.0% |

|||||||

|

|

6248 · Fence repair |

0.00 |

500.00 |

-500.00 |

0.0% |

|||||||

|

|

Total 6245 · Security |

793.24 |

1,450.00 |

-656.76 |

54.71% |

|||||||

|

|

Total 6200 · Repairs & Maint |

31,050.70 |

33,450.00 |

-2,399.30 |

92.83% |

|||||||

|

|

6215 · Beautification Committee |

1,365.53 |

2,000.00 |

-634.47 |

68.28% |

|||||||

|

|

6300 · Administrative | |||||||||||

|

|

6310 · Fees and Licenses |

1,226.80 |

400.00 |

826.80 |

306.7% |

|||||||

|

|

6315 · Income Taxes |

450.00 |

10.00 |

440.00 |

4,500.0% |

|||||||

|

|

6320 · Submerged Land Lease |

7,236.45 |

7,100.00 |

136.45 |

101.92% |

|||||||

|

|

6325 · Bank fees |

1,294.85 |

1,320.00 |

-25.15 |

98.1% |

|||||||

|

|

6330 · Real Property Taxes |

34,280.23 |

33,000.00 |

1,280.23 |

103.88% |

|||||||

|

|

6340 · Hayden Island Business Park |

2,393.03 |

1,400.00 |

993.03 |

170.93% |

|||||||

|

|

6350 · Insurance |

24,711.00 |

24,000.00 |

711.00 |

102.96% |

|||||||

|

|

6360 · Supplies & Postage |

872.38 |

720.00 |

152.38 |

121.16% |

|||||||

|

|

6370 · Legal Services |

215.00 |

1,400.00 |

-1,185.00 |

15.36% |

|||||||

|

|

6380 · Accounting Services |

250.00 |

250.00 |

0.00 |

100.0% |

|||||||

|

|

6396 · Miscellaneous |

0.00 |

250.00 |

-250.00 |

0.0% |

|||||||

|

|

Total 6300 · Administrative |

72,929.74 |

69,850.00 |

3,079.74 |

104.41% |

|||||||

|

|

8000 · Suspense |

0.00 |

||||||||||

|

|

Total Expense |

141,543.91 |

143,520.00 |

-1,976.09 |

98.62% |

|||||||

|

|

Net Ordinary Income |

3,053.45 |

288.00 |

2,765.45 |

1,060.23% |

|||||||

|

|

Other Income/Expense |

|||||||||||

|

|

Other Income |

|||||||||||

|

|

5100 · Reserves assessments |

47,712.00 |

47,712.00 |

0.00 |

100.0% |

|||||||

|

|

5300 · Reserves bank interest |

9,373.33 |

3,696.00 |

5,677.33 |

253.61% |

|||||||

|

|

Total Other Income |

57,085.33 |

51,408.00 |

5,677.33 |

111.04% |

|||||||

|

|

Other Expense | |||||||||||

|

|

7000 · Reserve expenses | |||||||||||

|

|

7300 · Roofing |

0.00 |

||||||||||

|

|

Total 7000 · Reserve expenses |

0.00 |

||||||||||

|

|

Total Other Expense |

0.00 |

||||||||||

|

|

Net Other Income |

57,085.33 |

51,408.00 |

5,677.33 |

111.04% |

|||||||

|

Net Income |

60,138.78 |

51,696.00 |

8,442.78 |

116.33% |

||||||||

|

|

||||||||||||

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

2007

Income Statement and Budget (Balance Sheet Below)

|

|

2006 | 2005 | $ Change | % Change | 2007 Budget | Notes |

| Operating Revenues and Expenses | ||||||

| Revenues | ||||||

| 4100 · Operating assessments | 157,920.00 | 171,360.00 | -13,440.00 | -7.84% | 143,9200 | |

| 4200 · Late Fees | 210.67 | 0.00 | 210.67 | N/A | ||

|

4250 · Penalties |

100.00 | 0.00 | 100.00 | N/A | ||

| 4300 · Operating Bank Interest | 0.00 | 7.06 | -7.06 | N/A | ||

| 4400 · Miscellaneous Revenue | 45.00 | 149.50 | -104.50 | -68.9% | ||

| Total Revenues | 158,275.67 | 171,516.56 | -13,240.89 | -7.72 | 143,920 | |

| Expenses | ||||||

| 6100 · Operating | ||||||

| 6110 ·Electricity | 3,122.22 | 3,371.03 | -248.81 | -7.38% | 3,300 | A |

| 6120 · Garbage | 11,303.30 | 10,675.02 | 628.28 | 5.89% | 8,400 | B |

| 6130 ·Telephone | 462.40 | 522.24 | -59.84 | -11.46% | 516 | C |

| 6140 · Water | 28,653.45 | 31,067.55 | -2,414.10 | -7.77% | 26,000 | D |

| Total 6100 · Operating | 43,541.37 | 45,635.84 | -2,094.47 | -4.59% | 38,216 | |

| 6200 · Repairs & Maintenance | 8,450 | E | ||||

| 6210 · Landscaping | 15,131.30 | 14,126.46 | 1,004.84 | 7.11% | 12,600 | F |

| 6220 · Gate Maintenance | 661.00 | 3,627.00 | -2,966.00 | -81.78% | 1,800 | |

|

6230 · Pipes Maintenance |

379.42 | 4,862.38 | -4,482.96 | -92.2% | 600 | |

| 6240 · General Maintenance | 13,702.64 | 3,640.78 | 10,061.86 | 276.37% | 12,000 | |

|

6245 · Security |

5,400.00 | 0.00 | 5,400.00 | N/A | 0 | |

| Total 6200 · Repairs & Maintenance | 35,274.36 | 26,256.62 | 9,017.74 | 34.35% | 35,450 | |

|

6300 · Administrative |

||||||

| 6310 · Fees and Licenses | 387.00 | 652.16 | -265.16 | -40.66% | 400 | |

| 6315 · Income Taxes | 10.00 | 10.00 | 0.00 | 0.00 | 10 | |

| 6320 · Submerged Land Lease | 7,039.50 | 6,844.00 | 195.50 | 2.86% | 7,100 | |

| 6325 · Bank Fees | 1,233.85 | 0.00 | 1,233.85 | 100.0% | 1,320 | |

| 6330 · Real Property Taxes | 31,704.44 | 53,975.45 | -22,271.01 | -41.26% | 33,000 | |

| 6340 · Hayden Island Business Park | 1,312.52 | 919.52 | 393.00 | 42.74% | 1,400 | |

| 6350 · Insurance | 30,039.60 | 20,980.45 | 9,059.15 | 43.18% | 24,000 | G |

| 6360 · Supplies & Postage | 633.92 | 1,022.01 | -388.09 | -37.97% | 720 | |

|

6370 · Legal Services |

1,398.12 | 535.72 | 862.40 | 160.98% | 1,400 | |

| 6380 · Accounting Services | 225.00 | 1,100.00 | -875.00 | -79.55% | 250 | |

| 6390 · Management Services | 0.00 | 5,638.90 | -5,638.90 | N/A | 0 | |

| 6395 · Bad Debts | 281.13 | 628.15 | -347.02 | -55.25% | 0 | |

| 6398 · Miscellaneous | 250.00 | 495.00 | -245.00 | -49.5% | 250 | |

| Total 6300 · Administrative | 74,515.08 | 92,801.36 | -18,286.28 | -19.71% | 69,850 | |

| 8000 · Suspense | 285.00 | 0,00 | -285.00 | N/A | 0 | |

| Total Expense | 153,615.81 | 164,693.82 | -11,078.01 | -6.73% | 143,516 | |

| Excess of operating revenues over expenses | 4,659.86 | 6,822.74 | -2,162.88 | -31.7% | 404 | |

| Reserve Account | ||||||

| 5100 · Reserves Assessments | 33,600.00 | 19,440.00 | 14,160.00 | 72.84% | 33,600 | |

| 5300 · Reserves Interest Income | 3,611.93 | 1,312.03 | 2,299.90 | 175.29% | 3,700 | |

| Additional Reserves for Garage Roof | 14,000 | |||||

| Total Increase to Reserve Account | 37,211.93 | 20,752.03 | 16,459.90 | 79.32% | 37,300 | |

| Excess of revenues over expense – Operations plus Reserves | 41,871.79 | 27,574.77 | 14,297.02 | 51.85% | 37,704 |

A Plus 5% over last Year

B With new service

C Rounded to 43 per month

D With benefit of new sewer meter

E Includes 5,000 for gate operator

450 for paint (like safety lines)

500 fire extinguisher maintenance

2000 Beatification per committee request

F No bark this year cause for reduction

G 2006 w/o 2005 paid in 2006

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

2006

|

2005 Actual |

2005 Budget |

2005 Actual |

Variation |

|

| Income | ||||

|

4100-Operating Assessments |

171,360.00 |

157,920.00 |

||

|

4300-Operating Bank Interest |

7.08 |

|

||

|

4400- Misc Income |

149.50 |

|

||

|

|

||||

|

Total Income |

171,516.56 |

157,920.00 |

||

Expense |

|

|||

|

Operating |

|

|||

|

Electricity |

3,371.03 |

3,600.00 |

||

|

Garbage |

10,675.02 |

11,040.00 |

||

|

Telephone |

522.24 |

500.00 |

||

|

Water & Sewer |

31,067.55 |

36,000.00 |

||

|

Total Operating |

45,635.84 |

51,140.00 |

||

|

|

|

|||

|

Repairs and Maintenance |

|

|||

|

Landscaping |

14,126.46 |

15,000.00 |

||

|

Gate maintenance |

3,627.00 |

4,300.00 |

||

|

Pipes maintenance |

4,862.38 |

1,600.00 |

||

|

General maintenance |

3,640.78 |

9,600.00 |

||

|

Security |

9,000.00 |

|||

|

Total Maintenance |

26,256.62 |

51,144.00 |

||

|

|

|

|||

|

Administration |

|

|||

|

Income taxes |

10.00 |

10.00 |

||

|

Submerged land lease |

6,844.00 |

6,900.00 |

||

| Fees & Licenses | 300.00 | 1,200.00 | ||

|

Real property taxes |

53,975.45 |

32,000.00 |

||

|

Hayden Island Bus Park Dues |

919.52 |

2,000.00 |

||

|

Insurance |

20,980.45 |

22,700.00 |

||

|

Supplies and postage |

1,022.01 |

0.00 |

||

|

Legal services |

535.72 |

600.00 |

||

|

Accounting services |

1,100.00 |

1,200.00 |

||

|

Management fees & expenses |

5,638.90 |

0.00 |

||

|

Bad Debts |

628.15 |

0 |

||

| Misc | 495.00 | 0 | ||

|

Total Administration |

92,801.36 |

66,610.00 |

||

|

|

|

|||

|

Total Expense |

164,693.82 |

171,360.00 |

||

| Net Ordinary Income | 6,822.74 | 66.00 | ||

| Other Income/Expense | ||||

| Reserve Assesment | 19,440.00 | 33,600.00 | ||

| Net Income | 33,666.00 |

2005

|

2005 Actual |

2005 Budget |

2005 Actual |

Variation |

|

| Income | ||||

|

4100-Operating Assessments |

171,360.00 |

157,920.00 |

||

|

4300-Operating Bank Interest |

7.08 |

|

||

|

4400- Misc Income |

149.50 |

|

||

|

|

||||

|

Total Income |

171,516.56 |

157,920.00 |

||

Expense |

|

|||

|

Operating |

|

|||

|

Electricity |

3,371.03 |

3,600.00 |

||

|

Garbage |

10,675.02 |

11,040.00 |

||

|

Telephone |

522.24 |

500.00 |

||

|

Water & Sewer |

31,067.55 |

36,000.00 |

||

|

Total Operating |

45,635.84 |

51,140.00 |

||

|

|

|

|||

|

Repairs and Maintenance |

|

|||

|

Landscaping |

14,126.46 |

15,000.00 |

||

|

Gate maintenance |

3,627.00 |

4,300.00 |

||

|

Pipes maintenance |

4,862.38 |

1,600.00 |

||

|

General maintenance |

3,640.78 |

9,600.00 |

||

|

Security |

9,000.00 |

|||

|

Total Maintenance |

26,256.62 |

51,144.00 |

||

|

|

|

|||

|

Administration |

|

|||

|

Income taxes |

10.00 |

10.00 |

||

|

Submerged land lease |

6,844.00 |

6,900.00 |

||

| Fees & Licenses | 300.00 | 1,200.00 | ||

|

Real property taxes |

53,975.45 |

32,000.00 |

||

|

Hayden Island Bus Park Dues |

919.52 |

2,000.00 |

||

|

Insurance |

20,980.45 |

22,700.00 |

||

|

Supplies and postage |

1,022.01 |

0.00 |

||

|

Legal services |

535.72 |

600.00 |

||

|

Accounting services |

1,100.00 |

1,200.00 |

||

|

Management fees & expenses |

5,638.90 |

0.00 |

||

|

Bad Debts |

628.15 |

0 |

||

| Misc | 495.00 | 0 | ||

|

Total Administration |

92,801.36 |

66,610.00 |

||

|

|

|

|||

|

Total Expense |

164,693.82 |

171,360.00 |

||

| Net Ordinary Income | 6,822.74 | 66.00 | ||

| Other Income/Expense | ||||

| Reserve Assesment | 19,440.00 | 33,600.00 | ||

| Net Income | 33,666.00 |

Balance Statement December 31

| 2004 | 2005 | |

| ASSETS | ||

| Current Assets | ||

| Checking/Savings | ||

| Checking | 5,658.87 | 13,554.25 |

| Savings | ||

| Reserve Fund | 50,774.65 | 76,827.56 |

| Tax & Insurance Fund | 14,404.12 | |

| Savings | 10,000.00 | |

|

Subtotal |

56,433.52 | 114,785.93 |

| Assessments Receivable | 25,227.06 | (13.42) |

| TOTAL ASSETS | 81,660.60 | 114,772.51 |

| LIABILITIES & EQUITY | ||

| Current Liabilities | ||

| Accounts Payable | 34,272.26 | 0 |

| Developer Payable | 10,190.60 | 0 |

|

Subtotal |

44,462.86 | 0 |

| Equity | ||

| Operating Fund Balance | (20,257.79) | (13,435.05) |

| Reserve Fund Balance | 57,455.53 | 78,207.56 |

| Contribution to Capital | 50,000.00 | |

|

Subtotal |

37,197.74 | 114,772.51 |

| TOTAL LIABILITIES & EQUITY | 81,660.60 | 114,772.51 |

Balance Sheet

Accounts receivable shows a credit balance as some slips were prepaid by the LLC before selling and prompt (before month end) payment of the monthly assessment by some slip owners.

Schwab $50,000 of this account is now invested in CDs to increase the investment income. During November I will move approximately $36,000 out of the Schwab account to pay property taxes and flood insurance.

Income Statement

At the end of October we are still under budget primarily due to insurance, taxes and management fees. With the November tax and insurance payments, expenses will more closely match the budget.

This year the total property tax expense will be $53975.45. The expense is significantly higher than past years because WHIMOA paid 2/3 of the 2004 taxes and all the 2005 taxes during 2005. By paying the 2005 taxes in full, we received a discount of $962 and will not pay any interest charges. By setting aside cash throughout the year, the property taxes will be paid in full every year.

2004

|

Budget 2004 |

Actual 2004 |

|

| Income | ||

| 4100-Operating Assessments |

163,880.00 |

163,968.00 |

| 4300-Operating bank interest | 27.77 | |

| 4400- Misc Income | 0.00 | |

| 183,880.00 | 179,739.07 | |

| Expense | ||

| 6100 Operating | ||

| 6110-Electricity | 2,760.00 | 3,193.80 |

| 6120-Garbarge | 7,100.00 | 8,575.27 |

| 6130-Telephone | 600.00 | 501.98 |

| 8140-Water | 34,560.00 | 37,740.92 |

| Total Operating | 45,020.00 | 50,011.97 |

| 6200 Repairs and Maintenance | ||

| 6210-Landscaping | 12,000.00 | 14,853.70 |

| 6220-Gate maintenance | 1,500.00 | 1,833.88 |

| 8230-Pipes maintenance | 1,000.00 | 4,354.09 |

| 6240-General maintenance | 7,000.00 | 8,294.39 |

|

Total Maintenance |

21,500.00 | 29,136.06 |

| 6300 Administration | ||

| 6310-Fees and licenses | 300.00 | 537.27 |

| 6315-Income taxes | 10.00 | 10.00 |

| 6320-Submerged land lease | 8,450.00 | 6,635.00 |

| 6330-Real property taxes | 36,000.00 | 34,207.74 |

| 6340-Hayden island Bus Park Dues | 2,800.00 | 1,871.65 |

| 6350-Insurance | 27,400.00 | 33,981.19 |

| 6360-Supplies and postage | 500.00 | 247.45 |

| 6370-Legal services | 6,400.00 | 630.85 |

| 6380-Accounting services | 2,500.00 | 2,867.10 |

| 6390-Management fees & expenses | 15,000.00 | 21,022.67 |

| 6395-Bad Debts | 3,353.31 | |

|

Total Administration |

97,360.00 | 105,364.23 |

| Total Expense | 163,880.00 | 184,512.26 |

|

Net Ordinary Income (Loss) |

(4,773.19) | |

| Other Income/Expenses | ||

| Other Income | ||

| 5100-Reserves assessments | 16,560.00 | 17,276.81 |

| 5300-Reserves bank interest | 265.32 | |

|

Total other income |

18,560.00 | 17,542.13 |

| Other Expenses | ||

| 7000-Reserve Expenses | ||

| 7200-Security Lighting | 2.318.61 | |

|

Total Other Expenses |

2,318.61 | |

|

Net Other Income |

15,223.52 | |

| Net Income (Loss) | 10,450.33 | |

2003

|

Budget 2003 |

Actual 2003 |

|

| Income |

|

|

| 4100-Operating Assessments |

144,480.00 |

144,480.00 |

| 4300-Operating bank interest |

|

24.91 |

| 4400- Misc Income |

|

|

| |

144,480.00 |

144,504.91 |

| |

|

|

| Expense |

|

|

| 6100 Operating |

|

|

| 6110-Electricity |

2,800.00 |

2,750.00 |

| 6120-Garbarge |

8,840.00 |

7,006.74 |

| 6130-Telephone |

380.00 |

566.42 |

| 8140-Water |

21,800.00 |

29,718.82 |

| Total Operating |

31,600.00 |

40,041.18 |

| |

|

|

| 6200 Repairs and Maintenance |

|

|

| 6210-Landscaping |

9,800.00 |

15,176.90 |

| 6220-Gate maintenance |

1,500.00 |

3,260.00 |

| 8230-Pipes maintenance |

1,000.00 |

891.50 |

| 6240-General maintenance |

7,900.00 |

8,168.91 |

| Total Maintenance |

20,000.00 |

25,267.31 |

| |

|

|

| 6300 Administration |

|

|

| 6310-Fees and licenses |

700.00 |

229.84 |

| 6315-Income taxes |

50.00 |

10.00 |

| 6320-Submerged land lease |

8,400.00 |

6,442.00 |

| 6330-Real property taxes |

32,000.00 |

32,615.36 |

| 6340-Hayden island Bus Park Dues |

300.00 |

2,756.62 |

| 6350-Insurance |

25,600.00 |

27,339.73 |

| 6360-Supplies and postage |

1,300.00 |

260.28 |

| 6370-Legal services |

500.00 |

700.00 |

| 6380-Accounting services |

4,000.00 |

2,427.36 |

| 6390-Management fees & expenses |

17,200.00 |

17,200.00 |

| 6395-Bad Debts |

|

1541.00 |

| Total Administration |

90,650.00 |

94,121.99 |

| |

|

|

| Total Expense |

142,250.00 |

159,481.08 |

| |

|

|

| Net Ordinary Income (Loss) |

2,230.00 |

(14,956.17) |

| |

|

|

| Other Income |

|

|

| 5100-Reserves assessments |

16,560.00 |

16,288.04 |

| 5300-Reserves bank interest |

|

74.71 |

| Total other income |

16,560.00 |

18,362.75 |

| |

|

|

| Maintenance charged to reserves – painting |

|

|

| LLC contribution for painting (based upon slips owned at 10/1/02) |

|

|

| Net addition to reserves |

16,580.00 |

|

| |

|

|

| Special assessment per slip to fund deficit |

|

|

| |

|

|

| Monthly assessment beginning January 1, 2004 |

|

|

| Plus $30 reserves |

|

|

| Total 2004 Monthly Assessment per slip |

|

2002

|

Income Statement 2002 |

Balance Sheet 2002 |

|

Ordinary Income/Expense Income 4100 · Operating assessments 109,200.00 4300 · Operating bank interest 17.87 4400 · Miscellaneous revenue 25.00 Total Income 109,242.87 Expense 6100 · Operating 6110 · Electricity 2,669.56 6120 · Garbage 6,553.00 6130 · Telephone 486.27 6140 · Water 20,214.52 Total 6100 · Operating 29,923.35 6200 · Repairs & Maint 6210 · Landscaping 11,946.68 6220 · Gate Maintenance 146.00 6230 · Pipes Maintenance 1,715.00 6240 · General maintenance 7,544.90 Total 6200 · Repairs & Maint 21,352.58

6300 · Administrative 6310 · Fees and Licenses 514.71 6320 · Submerged Land Lease 6,261.00 6330 · Real Property Taxes 31,530.98 6340 · Hayden Island Business Park 230.00 6350 · Insurance 17,258.37 6360 · Supplies & Postage 1,164.07 6370 · Legal Services 73.82 6380 · Accounting Services 4,066.10 6390 · Management Services 19,121.44 Total 6300 · Administrative 80,220.49 Total Expense 131,496.42 Net Ordinary Income -22,253.55 Other Income/Expense Other Income 5100 · Reserves assessments 13,682.91 5300 · Reserves bank interest 270.46 Total Other Income 13,953.37 Net Other Income 13,953.37 Net Income -8,300.18 |

ASSETS Current Assets Checking/Savings 1100 · Petty Cash 5.34 1130 · Liberty Funds 28,380.51 1140 · Sterling Checking Account 721.18 Total Checking/Savings 29,107.03 Accounts Receivable 1200 · Assessments receivable 6,787.09 1300 · Developer receivables -136.30 Total Accounts Receivable 6,650.79 Total Current Assets 35,757.82 TOTAL ASSETS 35,757.82 LIABILITIES & EQUITY Liabilities Current Liabilities Accounts Payable 2300 · Vendor payables 19,121.44 + Total Accounts Payable 19,121.44 Other Current Liabilities 2200 · Developer payables 10,190.60 ++ Total Other Current Liabilities 10,190.60 Total Current Liabilities 29,312.04 Total Liabilities 29,312.04 Equity 3500 · Operating fund balance -19,337.89 3600 · Reserves fund balance 34,083.85 Net Income -8,300.18 Total Equity 6,445.78 TOTAL LIABILITIES & EQUITY 35,757.82

+ Due Evergreen for Bob

++ Advances from LLC

|